Understanding your business growth type will impact strategy and profits.

Recently, I was fortunate enough to work with a rapidly growing business that grew by over 100% compound annual growth rate (CAGR) over three years. Anything over 40% CAGR can be considered hyper-growth, so this was incredible to witness.

Being in a hyper-growth company can be an exhilarating ride. Lots of new customers, new employees and new international markets to tap into – it was a whirlwind of globetrotting, Zoom meetings and fighting to stay alive. We scrambled for every dollar, and we always felt like we were just a few months away from losing it all.

I learned a few things about the relationship between growth and profitability.

Hyper-growth

This type of growth is normally experienced by young businesses (or industry disruptors) as they mature through the scaling phase of business development. Defined as the steep part of the growth curve, counter-intuitively, this type of growth is high-risk. The cost of new customer acquisition and onboarding multiplied by growth rate will always exceed net operating margins, meaning there’s a lot to potentially gain, but you’re also teetering on the brink of losing it all.

For these businesses, new customers significantly exceed existing customers and recruitment within the customer success team lags new business. This can lead to bad customer experiences, which ultimately increases customer churn and slows down new sales.

Typically, this type of growth will attract funding as an investment in operations will resolve the scaling issues for a post-revenue business with proven customer fit and sales conversion.

So, once we secure funding, we build the team and the profits will flow, right?

Not necessarily. Depending on the type of business and market reach (is it global?), the business may remain unprofitable for many years if the CAGR remains high. The business will continue to attract funding on the promise of profits being realised at some point in the future.

It’s common for listed start-ups to rapidly grow and lose money for decades before they become profitable.

So, when does this type of business achieve profitability?

The answer: When growth slows.

At some point, the business will achieve optimal market penetration (slowing growth rate) and operational efficiencies (reduce costs to acquire and service customers). Slowed growth with increased profits indicates maturity. Depending on the type of business, when it matures, it may enter a phase of profitable linear or episodic growth.

Linear growth

Growing organically and prioritising profit will lead to a straight-line growth graph (it’s normal to have less than 20% CAGR) that mitigates the risk of over-investment and competitive activities which threaten market share.

Achieving 20% CAGR will more than double your business in three years, while a 10% CAGR will take over seven years to achieve the same result. This will feel like rapid growth for many small-to-medium business (SMB) owners if it continues in perpetuity. In reality, the business development curve for many SMBs tends to have an incrementally declining growth rate until it reaches a plateau.

If your growth has plateaued, it can be an indication of a declining business even when profits are high. A business that under-invests profits back into the organisation will negatively impact new business and destabilise operations through attrition or customers and loss of resources.

When low growth profits are eroded by inflation, maintaining a growth rate above the inflation is critical to maintaining stakeholder value.

Episodic growth

Episodic growth can occur due to seasonal markets or large projects, and in such cases, it tends to be well understood. Profit forecasts take into account slow periods and flexible resourcing agreements, allowing for business expenses to be adjusted up or down as needed.

However, episodic growth can also occur due to inefficient sales and marketing activity. Build-up of activity around common discounting periods (like end of financial year) creates clumping of sales and leads to an artificial peak in demand.

This creates peaks and troughs in the business operations that do not allow for flexible resourcing. While the business may be growing, there can also be a reduction in profit due to operational downtime. Smoothing out the episodes by filling the troughs (reducing downtime) or reducing the peaks (fewer customers could in fact be more profitable) will lead to more consistent growth and profitability.

Conclusion

Personally, I think linear growth with a slow build in sales and operational momentum is preferable to hyper-growth. There are so many examples of start-ups that never make it to profitability regardless of the significant growth metrics.

Who wins: the tortoise or the hare?

Intriguingly, linear growth can occur together with episodic growth when a mature business maintains organic growth and plans its growth by acquisition or by bringing new products to market. Understanding how the two growth strategies play out in that scenario can mitigate the risk of one impacting the other.

Many companies that I have been involved in throughout my career are focused on achieving growth, but they may not understand how to create it. The most successful businesses have been the ones that make growth a central part of their business plan.

Understanding the type of growth your business is experiencing and its impact on profits is the first step.

We trust we’ve provided you with some valuable takeaways in this article. Please follow or subscribe to receive more Klugo Briefing Posts in future so you can benefit from more insights to help you grow your business sustainably.

About Klugo

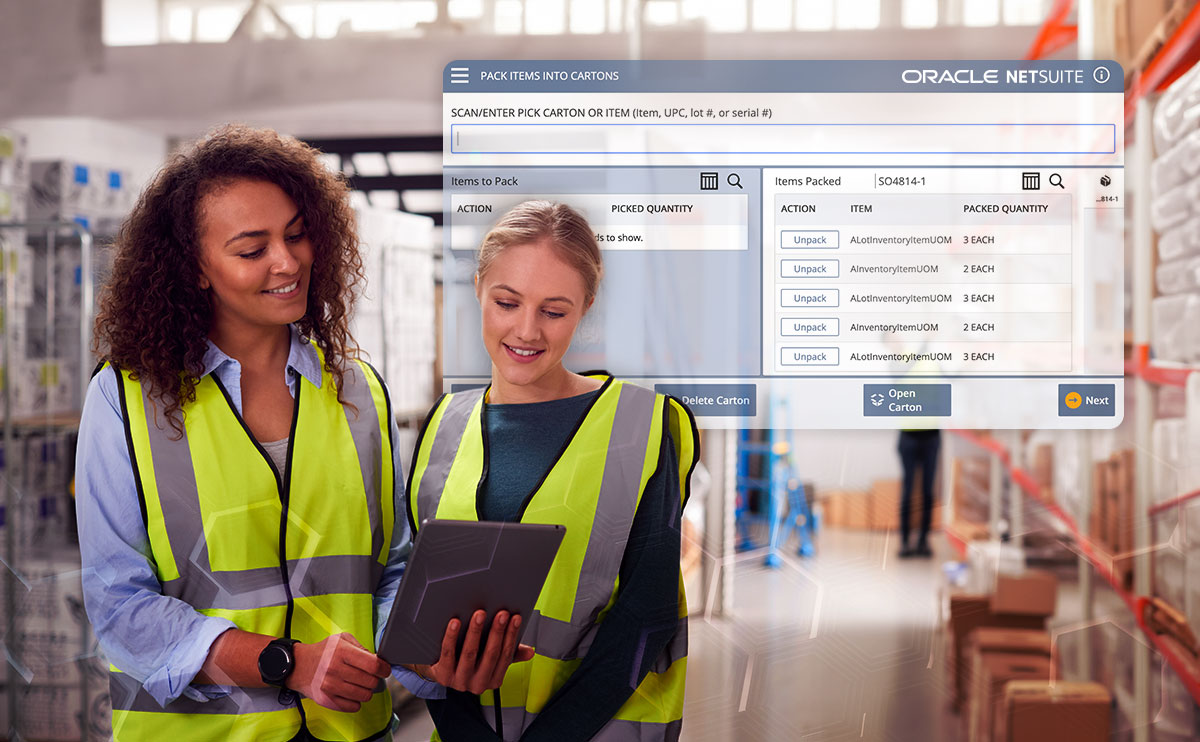

NetSuite + NextService

Klugo’s vision is to unlock the full operating potential of our customers to maximise the value of their business. We do this by helping our customers achieve operating excellence using NetSuite + NextService, the world-leading cloud ERP and FSM business platform for small-to-medium-sized businesses.